***Now updated for the 2015 financial year***

Income Calc – An all-inclusive Income Tax Calculator

“Tax is Complicated, using apps is not!”

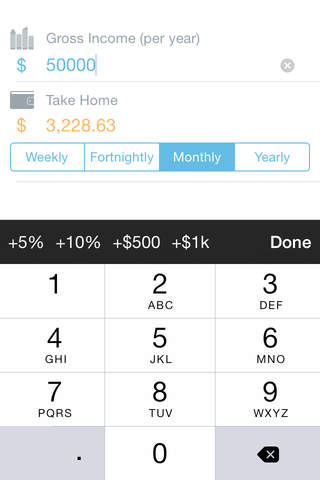

As tax time quickly approaches wouldnt it be nice to know how much tax you will need to pay? The Income Calc allows you to create an accurate illustration of your in pocket salary as well as your ato tax obligation. All you have to do is enter your salary and some basic details and the Income Calc will do all the hard work for you.

Our Income Calculator uses the official tax tables from the ATO (Australian Taxation Office) along with a range of formulas to calculate all aspects of your tax obligations. You simply enter your gross income. The rates and tables are adjusted each financial year so you can comfortably calculate accurate figures from different tax years as well as different tax situations. The Calculator incorporates all figures and aspects regarding your salary or wage, therefore the result you receive includes some money which you will receive in your payroll and tax return such as the low income tax offset (LITO).

University students can use the Income Calculator to calculate their compulsory HECS or Fee-Help contributions, so you can get ahead of the game and put money away before tax time.

The Income Calc has the power to calculate:

•Income Tax

•HECS/Fee-Help

•Medicare Levy

•Medicare Levy Surcharge

•Flood Levy (2011-2012)

•Low Income Tax Offset

Unlike other Income calculators the Income Calc is constantly releasing new features; our most recent features consist of:

•A PayRise Calculator – discover the impact a pay rise will have on your net income after tax.

•Medicare Levy Surcharge – Add the Medicare Levy Surcharge to your calculation.

•Works with Abnormal wages – the formula is built to work with irregular incomes ranging from low to high.

•Regular updates – We release regular updates to maintain consistency with the Australian Taxation Office (ato) tax tables.

Income Calc Support http://incomecalc.net/contact-us/

Disclaimer:

Although we have tested the Income for countless hours please be aware that the results that are calculated are an illustration based on scenarios created by the figures you have entered and therefore should be seen as an estimate. The results should not be seen as professional tax advice.